CITIC Limited today announced its full-year results for the period ended 31 December 2024.

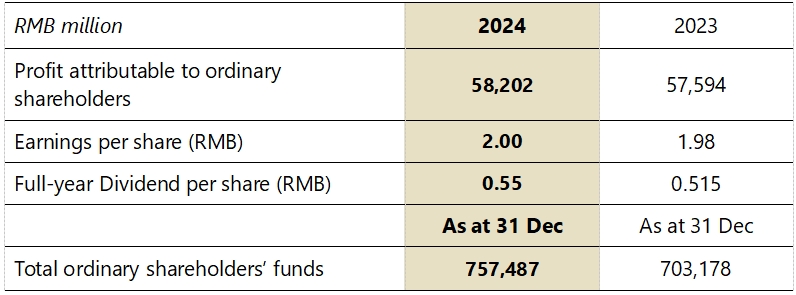

In 2024, CITIC Limited comprehensively deepened its reforms, leading to improved operating performance. The company reported annual revenue of RMB752.870 billion, representing an increase of 10.6% year on year, while profit attributable to ordinary shareholders was RMB58.202 billion, reflecting an annual increase of 1.1%. The Board of Directors has proposed a final dividend of RMB0.36 per share, bringing the total for 2024 to RMB0.55 per share with a payout ratio of 27.5%, up 1.5 percentage points from the previous year.

The financial segment has seen synchronised growth in both revenue and profit. CITIC Limited has established a coordinated and differentiated comprehensive financial service system while advancing its "Financial Core" initiative and facilitating the CITIC model of “Five Major Tasks” in finance. This has resulted in both revenue and profit attributable to ordinary shareholders increasing by 4.3% year on year. CITIC Financial Holdings has strengthened coordination in its institutional framework, resource allocation and product innovation to create a comprehensive service model across equity, loans, bonds and insurance. It has also launched the CITIC Equity Investment Alliance, serving around 11,000, or over 96%, of the first five batches of national specialised and sophisticated enterprises. CITIC Bank has increased its focus on quality lending, with revenue, profit and provision coverage ratio all recording positive growth, and outperforming the market in its management of the narrowing net interest margin. CITIC Securities continued to maintain its domestic leadership in core business areas in terms of debt underwriting, custody assets and assets under management with steady growth in key performance indicators. CITIC Trust saw a 27% growth in its trust assets and a 13% increase in the revenue of newly-contracted trust business. CITIC-Prudential Life continued to pivot towards higher margin and longer-term business and reported a new business value of RMB2.82 billion and a new business value ratio of 42%, representing annual growth of 16% and an increase of 10 percentage points, respectively.

The non-financial segments have continued to strengthen resilience. The launch of the “Industrial Starlink” initiative has accelerated business transformation and upgrade, resulting in a 14.7% annual increase in operating revenue, although profit attributable to ordinary shareholders decreased slightly by 2.4%. CITIC Pacific Special Steel and Nanjing Steel have achieved stronger profitability than their peers and contributed significantly to several key national projects such as the Shenzhen-Zhongshan Link. CITIC Dicastal has made market breakthroughs with its integrated die-casting technology and successfully delivered the first batch of products from its castings plant in Mexico, in accordance with its “Global Manufacturing, Global Service” initiative. CITIC Metal's KK Copper Mine Phase III has commenced production ahead of schedule, with the potential to become the world’s third largest copper mine. Meanwhile the Kipushi Zinc-Copper Mine began commercial production and is a strong contender for the world’s fourth largest zinc mine. Sino Iron remained profitable despite production cuts. CITIC Pacific Properties continued to maintain profitability amid ongoing industry pressures. CITIC Offshore Helicopter has launched regular helicopter services between Shenzhen and Zhuhai, creating new opportunities in the low-altitude economy.

Technological innovation increases in both quantity and quality. CITIC has made the development of new quality productive forces and the advancement of comprehensive innovation a key priority. In 2024, CITIC's total investment in technology was RMB25.2 billion, an 11% increase from the previous year, with a 3.34% R&D spending of total revenue. Key research projects have achieved notable breakthroughs, including bearing steel for aircraft engines, bearing steel for high-speed trains and intelligent aerial work robot systems. The “Artificial Intelligence Plus” initiative has been launched to create a series of general-purpose and specialised large language models, enhancing capabilities across various business segments. CITIC Dicastal’s Morocco plant has been recognised as Africa's first Global Lighthouse, making it the third advanced manufacturing facility established by CITIC.

International development has been gaining significant momentum. CITIC has continued to enhance its competitiveness through its “Going Global” strategy. CITIC Securities has made significant progress in expanding its presence in overseas markets with international business revenue contributions rising to 17.2%. CITIC Construction's new overseas contracts reached approximately RMB9 billion, an increase of 182% year on year. CITIC Heavy Industries recorded over 80% growth in new overseas orders, enabling its total new orders to reach a new high by surpassing RMB15 billion and achieving a year-on-year growth of 28.7%. CITIC has also been increasing its appeal as a vehicle for foreign investment. The company has launched the service brand “CITIC, Your Trusted Partner for Going Global and Coming to China”, positioning itself as a bridge to facilitate collaboration. The company has also organised events such as the “Chongqing Tour for German Advanced Manufacturing Enterprises” and the “Changsha Visit” for international strategic shareholders to promote trade and economic cooperation between China and the rest of the world, fostering mutual benefit and win-win outcomes.

Back